For me, there is no startup that gloms onto the depressing zeitgeist more wretchedly than Borro which follows mockney Wonga into the foggy world of dodgy debt – the very thing that got us into this mess in the first place.

According to their testimonials, “borro’s service sits somewhere between corporate investment and pawn broker”. Exactly one Planck Length away from the latter, because in my experience, corporate investment doesn’t tend to involve leaving your wristwatch as a deposit. With its lending service, Borro wraps the world of technology, banking and the Great Recession into a nasty little ball, with a story so perfectly intertwined that it reads like contemporary Dickens.

Borro.com, Boo.com with two ‘r’s.

Pawnbroking is when money is loaned against something real but which can be sold quicker than a house if massive interest is not paid. Its in the 7th circle of debt hell, three rings below sub prime, where desperate people sell their granny’s ring to buy crack. It’s not a nice business, but in times like this, its a thriving one.

Things that you can sell quickly have to be reasonably desirable, so pawnbrokers’ windows are full of the best things that poor people have ever owned, giving a bizarre impression of status amongst the deprived. In a pawnbroker you can find gold jewelry and expensive watches and brands that indicate respectability. If you were to extrapolate this further, a ridiculously distorted caricature of a pawnbroker in a dystopian Gatsby would store fine wines, famous paintings and fancy cars. But in this cartoon, behind the mask of respectability would be something vile and predatory.

Montague Tigg outside the London pawnshop.

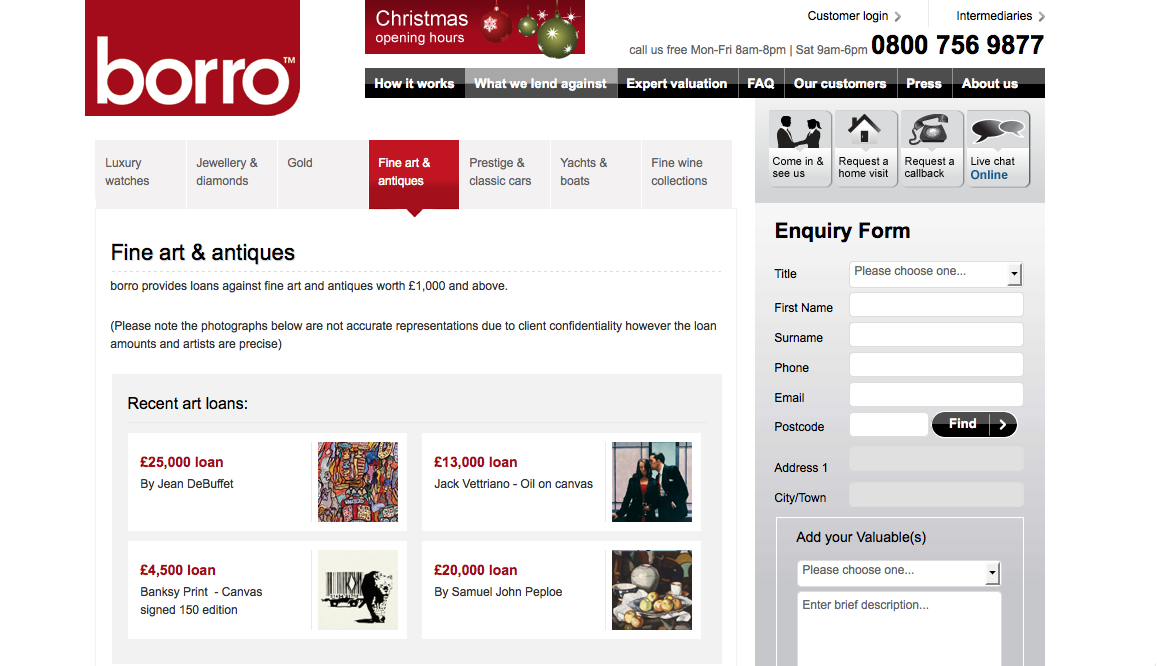

This Gatsbyesque image of diamonds & Porsche’s is exactly what Borro claim to have attached to pawnbroking and without the vileness behind. Sections on their site include diamonds, gold, fine-art and antiques, vintage cars and, unbelievably, luxury yachts. Items are stored in time-locked steel cages with ‘tremblers’ and 24/7 CCTV, except the yachts of course! In addition there is a section on their site about their values which outline ways they differ from the normal practice of pawnbroking.

There are a number of possible reasons for selling pawnbroking as upmarket, whether they work or not. You could try to make pawnbroking completely up-market with a more lucrative clientele or you could make it less downmarket using a few rich users as anchor clients to attract the masses or you could create the illusion that rich people are using the service to reduce the stigma which a user base of ordinary pawnbroker clients would feel.

So is it real?

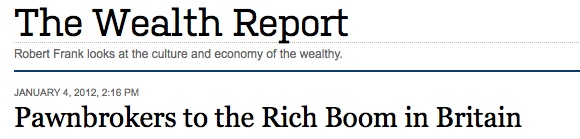

According to the Wall Street Journal, which has a piece based on an article in the London Times, it is: “Pawnbrokers to the Rich Boom in Britain” Now if this piece had predated Borro’s current PR push I might have been less skeptical that Borro is meeting a genuine demand for rich people to suddenly use pawnbrokers. But it doesn’t, and there are no other facts in the piece to backup any trend. Note the headline isn’t: “Pawnbroker to the Rich Booms in Britain” it’s plural, as if Borro is the winner in a vast new space. It isn’t just claiming that Borro is booming, but that the rich are also busting.

Its in the journal so it must be true.

But the rich are not going bust in droves. In fact one of the defining trends of the Great Recession is that the gap between rich and poor has widened. If, as the WSJ article says, “borro is sending tow trucks to posh enclaves like Kensington, Chelsea and Fulham to pick up an ever growing list of Porsches and BMW’s”, why have property prices bucked the national UK trend and steadfastly continued to increase there? Sure, the business of pawnbrokers may be thriving, expanding their client base to nip at the heels of the middle classes, but I doubt the last resort lender of the bottom percentage has become a favored recourse for the 1%. In fact the 1% are more likely to be found funding sites like Borro, these days, with nowhere else to put their money.

Here’s what I suspect happened – just my opinion. Borro hasn’t been around long enough to be sending tow trucks to pick up an ever growing list of Porsche’s even if it had struck gold by inverting a thousand year old model of lending. But they’d like to be and that is the story their PR agency is selling. Via the distortions of distance, cultural difference and the persuasiveness of PR flacks, a Wall Street Journalist was duped by a story that if it were true would be emblematic of the bigger picture, of a shit storm of debt default which can only be understood via anecdotes like this. It was a story the writer wanted to believe, it slipped through, no big deal.

But if a single missing ‘s’ in the WSJ makes this story fascinating for an OCD pedant like myself, a single letter typo on their website would be enough to excite Benedict Cumberbatch’s Sherlock.

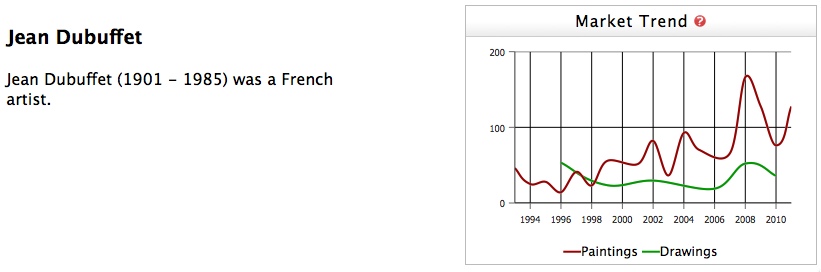

Borro have a list of things that people have already pawned, from Chateau Lafite claret to a Banksy print and a $40000 painting by Jean Dubuffet. Borro point out that the items “are not accurate representations due to client confidentiality however the loan amounts and artists are precise”.

Now aside from the fact that the confidentiality is convenient for a new business with little loot to show, or that DuBuffet paintings are about $750 per square inch meaning it was on the small size (less than 8 inches square), just like Arthur Daley’s memorably dodgy Levys [sic], DuBuffet isn’t spelled the way Borro did: DeBuffet.

DeBuffet is spelled DuBuffet

No big deal I guess, many sites have typos. Perhaps their picture expert did dictate the details and passed on no emails with what they had sold. But in the world of Occam’s Razor, I’m not buying it. Forgive me if the thought hasn’t crossed my mind that there are no DuBuffets in Borro’s trembler cage vaults, no lines of trucks waiting to haul Porsches out of Chelsea parking spaces and that neither the business of pawnbroking has become upmarket nor have the 1% become the latest victims of austerity.

Even if Borro is just a dressed up pawnbroker why is it intrinsically worse than a bank or other distressed debt sites like Wonga?

Banks and even Wonga don’t want you to go bust, or they don’t make money. Some people won’t pay, and the debts will have to be written off, but most will pay back and the net profit will be the interest minus the rate of default. But if everyone defaults on a pawnbroker they can still make money.

On the face of it, Borro aren’t trying to profit from a default. From their values section: “[We] Realize the highest value for our customers’ assets in the ‘last resort’ event of default, so that their loans are repaid in full and any excess is returned to them”. But think about that. If the loan is at a very high interest rate (I’ve seen figures like 60% bandied around) then the selling of collateral is already yielding a big profit before any money is handed back to the borrower. More importantly, with the hand back, there is no incentive for Borro to sell for a maximum beyond the loan value, and businesses where goodwill is in conflict with incentives are either not good will or not good business.

As I’ve written before, the last Internet boom failed when people though they could wave a magic wand at any offline business and Internetify it, bringing unimagined riches as keyboards clattered like a million cash registers. Borro looks to me to be making the same mistake, trying to take pawnbroking online and make it something that it isn’t from a business perspective and which fails to understand how the web works from a product one.

Why does all this matter?

This matters to me on every level. As an Internet entrepreneur, Borro is the kind of mad business that helped creat the last crash. As a technologist, if that happens again it will destroy faith in one of the things that can help get us out of the current mess via innovation or the desire to make things simpler and better such as Simple (BankSimple). And as a person, Simple in turn reflects the ability of technology to solve rather than perpetuate the money-for-its-own-sake mistake of the debt-fueled, financial arms race that nearly destroyed the global economy.

More than that, by having, what is suspect was harmless PR driven fiction enter the archives of the Wall Street Journal, with the title “Pawnbrokers to the Rich Boom in Britain” and the date “January 4, 2012” this innocuous article could be re-quoted to rewrite history and create the cruel illusion that the 1% were in this together with the 99%.