The physical constraints on the design of civilizations and how this relates to the Fermi Paradox.

One of the features of any civilization is information transfer. In fact, this is the principal feature that can be abstracted to create a mathematical foundation for the basis of most of the activities we associate with civilization: groups of people communicating with each other; trading; accumulation of knowledge and the end results of these things, namely culture and technology.

How might the physical limits on the ability to transfer information, (speed of light and quantum effects) affect the maximum and minimum possible sizes for civilizations and therefore the search for Extra Terrestrial Intelligence — SETI?

Current SETI is often based on two ideas:

1. that really advanced civilizations will grow bigger and capture larger and larger energy sources, from the home planet to the entire output of a star, via a Dyson sphere, say, to eventually colonize an entire galaxy. These are referred to as Kardashev Type I,II and III civilizations respectively. This idea implies we may be able to detect the big ones.

2. that the shift from a Type II to a Type III civilization can happen quite rapidly, because self replicating machines could spread though a galaxy. So if big ones are likely, there should be some, given the age of the universe and the fact the we are here.

Neither of these take into account the fact that individual members of civilizations need to be able to communicate with each other or they aren’t a single or evolving civilization, by definition.

Freeman Dyson has estimated it would take us 200 years to reach type I status at current growth levels, and with a modest growth rate of 1% per annum, Nikolai Kardashev estimated that it would take 3,200 years to reach a Type II status, and 5,800 years to reach Type III.

Given this growth rate and the following other parameters:

(a) the (in my opinion quite reasonable) belief that living things are a naturally occurring and inevitable form of low entropy order that efficiently channels the energy of an open system, towards waste, like the structure of eddies in turbulent flow.

(b) the estimated number of planets. Current estimates are around 100 Earth like planets alone, for every grain of sand on every beach and in every desert in the world.

(c) the age of the universe. 14 billion years.

…the original formation of the Fermi Paradox, ‘Where Are They?’, becomes ‘WTF are they?’.

Challenging the first assumption: that an advanced civilization will get bigger.

We are a long way off being a Kardachev Type I civilization in energy terms. We use around a millionth of the tiny proportion of the Sun’s energy that ends up on Earth, partly in the form of stored solar energy from fossil fuels. Yet we are already in danger of making our planet uninhabitable for us.

Our current issue is primarily CO2 emissions, but it could be that increased use of what are currently perceived to be sustainable energy sources turn out not to be, because we will have an ever increasing dominance on the rest of the living eco-system, if we continue to grow.

So what if we shrank, instead?

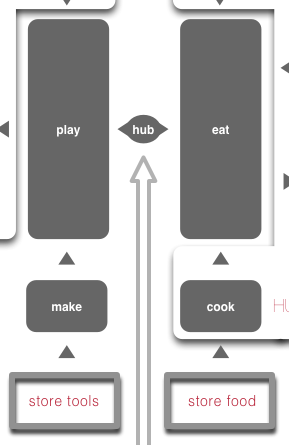

Our attempts to create a sustainable eco-system are largely based on efficiency and the logical extension of how to grow, say our population, with greater efficiency is for us to get smaller. If, at some point we replace ourselves with evolving, self-replicating machines, why not make them expand by making themselves smaller at each iteration, to colonize by contraction within the earth rather than expansion through the galaxy and through greater intelligence density rather than extent – more bits per atom.

Atoms are small, using the staple grain-of-sand measure, a single grain of sand contains more atoms than there are stars in ten million galaxies, so thinking machines could certainly get much smaller. But you need a lot of bits to store and process the information that we and our civilization requires, so going small may not be as good a solution as Kardashev style expansion is, long term, unless we can go a lot smaller than atoms.

As it happens, this potential growth via contraction to the smaller scale is gigantic, bits are theoretically limited to the planck scale and this is truly tiny. We sit almost exactly half way between the Planck scale and the size of the universe. There is theoretically as much room to colonize via contraction as there is via expansion.

But there is a limit to how viable a small machine could be in terms of physics. Even at the atomic level, quantum effects, and in particular, Heisenberg’s Uncertainty Principal, become significant. This says that you can’t know the position and momentum of something absolutely, because at the minimum you have to use light to measure it and at small scales, photons affect things as large as atoms. The Uncertainty Principal limits the scale at which effective measurement is possible and effective measurement is the key to information exchange, which at the beginning of this article, I suggested was the key abstraction for a mathematical analog of civilization. Civilization requires information exchange, and if you can’t exchange information reliably between one place and another, they cannot remain part of the same civilization.

The Uncertainty Principal creates an absolute Minimum Viable size for a civilization and it is larger than the atomic scale, i.e. ‘Reverse Karadashev’ expansion is limited to a size much, much bigger than the smallest things in the universe. It is analogous to Kardashev types not being possible beyond the size of the solar system.

Not many people would argue with this, that vastly smaller than sub-atomic machines are physically impossible, let alone sub-atomic civilizations. But nobody has challenged the physical constrains for the Maximum Viable Civilization and how that might affect both the number of potential civilizations and the ability to detect them — SETI.

The physical constraint at the large scale is also key to information exchange. At large scales, instead of message fidelity, the problem is speed of transfer. Information transfer is limited by the speed of light, and at the galactic scale it is incredibly slow. Our galaxy is an average sized one and it is 100,000 light years across. The average Kardashev type III civilization would take up to 200,000 years to get an answer to the question ‘are you there’ from one of its own members. Not knowing whether your other members exist or not, means that the speed of light suggests that a Kardashev type III civilization is impossible, on average, for members of a civilization who live for less than 200,000 years.

Several people have suggested that interstellar colonization would require ultra slow ‘metabolisms’ so that communication over large distances would appear realtime (remotely driving a rover on Mars is impossible in realtime, for humans) and organisms or any object which decays through use would be able to extend their lifetime. But this would mean that they would have to create ultra-stable artificial environments, where rivers didn’t change course or even meteorites strike to avoid having to react to things which changed much faster than their metabolism (or more accurately their brain cycle, or whatever) dictated. There is possibly a limit to this stability, and this implies a Minimum Metabolic Rate: MMR

Civilizations continue to build knowledge and culture over time, through the exchange of millions of bits of information, as humans do, every day. A Maximum Viable Size for a civilization may mean that a minimum number of bits of information exchange between members required to constitute a civilization which evolves as a whole is a relatively large number of messages, certainly much more than an endless series of pings of ‘Are you there? Yes. Oops, I’m dead.’ Call this the Minimum Messages per Lifetime: MML

Putting these parameters together (speed of light, age of the universe, MMR and MML) allows for a Drake-like equation where numbers can be plugged in to estimate the Maximum Viable size for a Civilization.

Say MML is 70,000 messages, this means that 70,000 messages would need to be sent back and forth (140,000 trips) across 100,000 light years for an average Kardashev Type III civilization to be possible. i.e. the lifespan of a single individual would have to be 14 billion years, which is larger than the age of the universe.

Given the age of the universe and the average size of a galaxy, for Kardashev Type III civilizations to be possible, MML must be less than 70,000.

For the messages to appear realtime, the rate of messages would need to be roughly correlated to the metabolic rate. Say the minimum MMR is one message per 714 years, this would mean that if MML was 70,000 the maximum sized civilization would be 100,000,000 light years across. i.e. a Kardashev III civilization would just be possible for the average galaxy, any faster then it wouldn’t.

Given the maximum value for MML, a Kardachev type III civilization is only possible if MMR is less than around 1 per 700 years.

If we start to estimate the viability of these parameters we can estimate the Maximum Viable size of a civilization and the possibility of Kardachev Type III civilizations.